Gold and Silver Stacking

50% Off in January!

Protect your wealth before the dollar collapses.

Worried about the economy, inflation, or the dollar collapse?

The Stacker’s Handbook and The Numismatics Handbook are your ultimate tools for protecting your savings with gold, silver, and rare U.S. coins.

Learn The History of Gold and Silver, how to stack smarter, trade metal without fiat risk, and collect real value — one ounce and one coin at a time.

Are These Gold and Silver Stacking Guides For You?

No matter where you are in your stacking journey, GoldSilverStacks has something for you.

New Stackers

Start strong with practical guidance on buying gold, silver, and collectible coins. Learn what to stack, when to buy, and how to build real value from day one.

Already Stacking

Take it further. Master the gold-silver ratio, time your trades, and refine your strategy with insights designed to grow your holdings — without relying on fiat.

Coin Collectors

Go deeper with rare coins, key dates, and mint errors. Discover the overlooked value in numismatics and learn how to build a collection that protects and multiplies wealth.

Trusted Source of Information for Gold and Silver Stackers

Mastering Gold and Silver Stacking For Lasting Wealth

GoldSilverStacks.com is more than a resource — it’s the foundation for building real value with physical metals and rare U.S. coins. Whether you’re stacking for the first time or looking to refine your strategy, our guides give you the tools to confidently navigate any market, inflation, or fiat crisis.

From accumulating gold & silver to actively collecting coins

- A Lifetime Strategy for Success: Know exactly what to do in any market. With a clear system for buying, holding, and trading, you’ll learn how to grow your stack with purpose — whether you’re stacking ounces or key-date coins.

- Clear, Actionable Insights: These aren’t theoretical guides. They deliver real-world stacking tactics used by smart investors to protect themselves from inflation, fiat collapse, and volatility. Learn how to leverage the gold-silver ratio and how to spot undervalued U.S. coins with collector upside.

- Simple and Easy to Implement: From understanding market cycles and timing swaps between metals, to identifying mint errors and coin grading signals — both books are built for quick learning and real results. No fluff, just strategy.

- The Tools to Build and Protect Wealth: Avoid stacking mistakes that cost time and money. You’ll get step-by-step frameworks for maximizing your holdings, timing profitable trades, flipping numismatic finds, and stacking without relying on fiat currency or third parties.

Our books give you the confidence to stack gold and silver with purpose, no matter the market. You’ll learn exactly how to allocate capital, rebalance your physical portfolio, and trade between metals using the gold-silver ratio. With proven stacking strategies and easy-to-follow tools, you’ll avoid costly mistakes and build long-term wealth in real assets. Once you see the results, you won’t stack without this system again.

The Numismatics Handbook isn’t just a collector’s guide — it’s a tool for real financial strategy. If you’re serious about protecting your savings through rare coins, key dates, and mint errors, this is the edge you’ve been looking for. Because when it comes to stacking with precision, the worst decision is no decision.

SHOP NOWDiscover the Ultimate Gold and Silver Stacking Strategy

Why Gold and Silver Matter

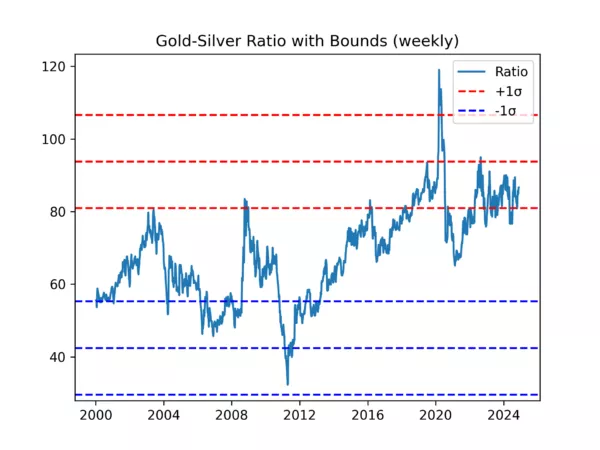

The gold-silver ratio shows you when to shift between metals. Stack silver when it’s cheap, flip to gold when it gains, and grow your ounces

The Power of Stacking Gold and Silver

Learn how to value your stack, trade metals at the right time, and grow your gold and silver holdings without relying on fiat.

Proven Strategies

You’ll learn how to manage premiums, time your purchases, and build a stack that performs in any market. This isn’t theory — it’s a system that works for real stackers

Practical Insights

Actionable tactics designed to optimize your investments and build your wealth systematically.

A Lifetime of Value

Our books provide a comprehensive roadmap, equipping you with the tools to confidently navigate precious metals markets for life—no other resources needed- in a simple and easy to implement manner.

Avoiding Common Pitfalls

Learn to sidestep costly mistakes that often trap new and experienced stackers alike, ensuring you stay on the path to success.

Ready to Stack Gold and Silver Like A Pro?

Powered By:

HTZCAP

Content Creator

HTZCAP is one of the most sought-after channels on YouTube for gold and silver news and market recaps. Trusted by stackers and investors alike, we deliver the insights you need to stay ahead in the world of precious metals.

What stackers say about us

—The Stacker’s Handbook is your fast track to stacking smarter, bigger, and better. Don’t just think about it—own it!“

Frequently Asked Questions About Stacking Gold and Silver

What is gold and silver stacking?

Gold and silver stacking is the process of accumulating physical precious metals—typically coins or bars—as a long-term strategy to preserve wealth, hedge against inflation, and reduce reliance on fiat currency.

Is stacking gold and silver a good investment?

Yes. Stacking physical gold and silver provides protection from inflation, currency devaluation, and market volatility. Unlike paper assets, stacked metals are tangible, globally recognized stores of value.

How do I start stacking gold and silver?

Start small with popular coins like American Silver Eagles or Gold Maples. Learn the gold-silver ratio, track premiums, and stack consistently over time. Avoid numismatic coins until you learn the basics.

What’s the best silver coin to stack?

Most stackers prefer government-issued silver bullion like American Silver Eagles, Canadian Silver Maples, or Britannias due to their liquidity, recognizability, and resale value.

Should I stack more silver or gold?

It depends on the gold-silver ratio. When the ratio is high, silver is considered undervalued, making it a better buy. When the ratio is low, gold may offer more stability. Many stackers shift between both.

What is the gold-silver ratio and how does it work?

The gold-silver ratio measures how many ounces of silver it takes to buy one ounce of gold. Stackers use it to time swaps—buying silver when the ratio is high and flipping to gold when it falls.

How do I store my gold and silver stack safely?

Store your stack in a fireproof safe at home or in a private vault. Avoid bank safety deposit boxes if you want quick access. Always keep records and avoid disclosing your holdings publicly.

What is the difference between stacking and collecting?

Stacking focuses on weight and intrinsic metal value. Collecting—especially numismatics—centers on rarity, condition, and historical significance. Many stackers eventually explore both.

Is it better to stack gold bars or coins?

Coins are more liquid and recognizable, especially in small denominations. Bars offer lower premiums at higher weights. Most stackers use a mix based on budget and goals.

Why are gold and silver stackers avoiding fiat currency?

Because fiat loses purchasing power over time. Gold and silver stackers prefer real, tangible assets that hold value and can’t be printed or inflated away by central banks.

What’s the deal with “how to get gold in Stacklands”?

“Stacklands” is a game where you stack resources, including gold. While it’s unrelated to physical stacking, many gamers searching that phrase also discover real gold and silver stacking.

Where can I learn more about stacking strategies?

Check out The Stacker’s Handbook for gold-silver ratio strategies, or The Numismatics Handbook if you’re exploring coins, mint errors, and key dates. Both offer step-by-step gold nad silver stacking tactics.

Read Our Latest Articles

Most Valuable Quarters: Top Key Dates & Values in 2026

Are Indian Head Coins Worth Anything in 2025?

Top 10 Most Valuable Indian Head Pennies (Worth $150,000+)

Visit Our Gold and Silver Blog