Gold and silver have been proven stores of value for thousands of years.

In 2025, with economic uncertainty, inflation concerns, and global debt levels skyrocketing, precious metals remain one of the best hedges against financial instability.

But how do you invest in gold and silver effectively? Should you buy physical bullion, ETFs, or mining stocks? Let’s break it down.

1. Why Invest in Gold and Silver?

Gold and silver are essential assets for wealth protection and portfolio diversification. Here’s why:

✅ Hedge Against Inflation – When fiat currencies lose value, gold and silver tend to rise in price.

✅ Crisis Protection – During recessions and market crashes, investors flock to safe-haven assets like gold.

✅ Industrial Demand for Silver – Silver is used in electronics, solar panels, medicine, and electric vehicles, adding demand beyond investment use.

✅ Gold-Silver Ratio Opportunity – When the gold-silver ratio is high (above 80), silver is undervalued; when it’s low (below 50), gold is the better bet.

📈 Key Insight: Many investors use the gold-silver ratio to time their purchases, flipping between gold and silver to maximize their holdings over time.

2. Best Ways to Invest in Gold and Silver in 2025

There are multiple ways to invest in gold and silver, each with its own risks and benefits. Which one is best for you?

Buying Physical Gold & Silver (Best for Long-Term Holders)

Owning physical bullion means you control your wealth. Unlike paper assets, it can’t be devalued by government policies or erased overnight.

Popular Physical Metals to Buy:

- Gold & Silver Coins – American Eagles, Canadian Maple Leafs, Krugerrands

- Gold & Silver Bars – 1 oz, 10 oz, 100 oz, and kilo bars (lower premiums than coins)

- Junk Silver Coins – U.S. 90% silver dimes, quarters, and half dollars (pre-1965)

- Gold & Silver Rounds – Private mint coins, often cheaper than government-issued coins

💡 Pro Tip: Always buy from reputable dealers to avoid fakes. Stick to:

- JM Bullion

- SD Bullion

- APMEX

- Kitco

- Local coin shops (but compare prices first!)

Gold & Silver ETFs (Easy to Trade, But No Physical Ownership)

If you want exposure to metal prices but don’t want to store physical bullion, ETFs are an option.

Popular Gold & Silver ETFs:

- SPDR Gold Trust (GLD) – Tracks gold prices

- iShares Silver Trust (SLV) – Tracks silver prices

- Sprott Physical Gold & Silver Trust (CEF) – Holds allocated bullion

⚠️ Warning: ETFs are paper gold and silver, not real metal. In a true financial crisis, you may not be able to redeem physical metal.

Gold & Silver Mining Stocks (Higher Risk, Higher Reward)

Mining stocks often outperform bullion in a bull market, but they come with added risks (company mismanagement, political instability, and operational failures).

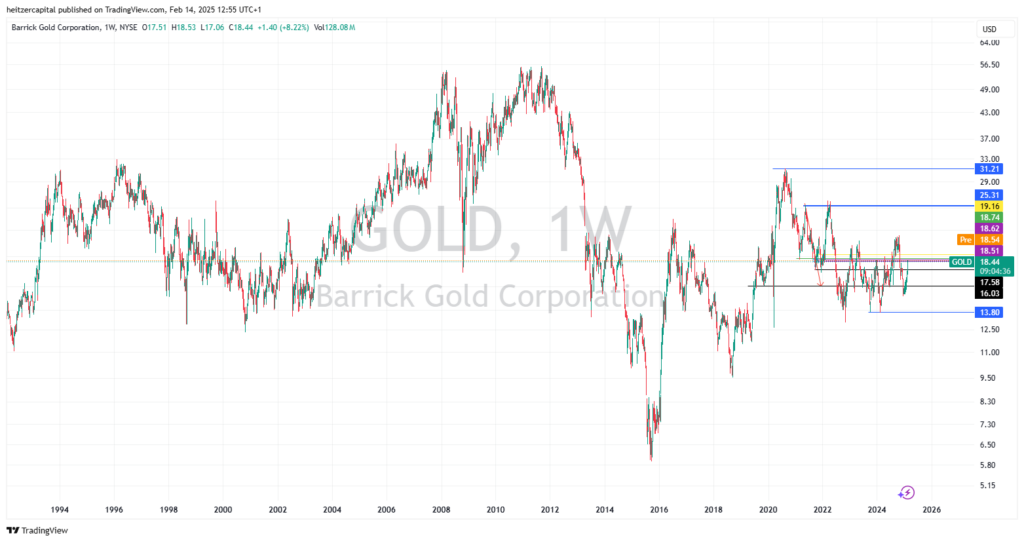

Top Gold Stocks: Newmont (NEM), Barrick Gold (GOLD)

Top Silver Stocks: First Majestic Silver (AG), Pan American Silver (PAAS)

Royalty & Streaming Companies: Franco-Nevada (FNV), Wheaton Precious Metals (WPM)

Mining stocks can be profitable during gold and silver rallies, but they also crash hard in downturns.

Gold & Silver Futures (For Advanced Traders)

Futures contracts allow traders to speculate on gold and silver prices without owning the metal. These are high-risk, high-reward instruments best left to professionals.

Key Risks: Leverage, price manipulation, and contract expiration traps.

3. Where to Store Physical Gold & Silver

If you own physical metals, you need safe storage options to protect your investment.

- Home Safe – Fireproof, waterproof, and bolted down.

- Bank Safe Deposit Box – Secure but not insured for precious metals.

- Private Vault Storage – Reputable companies like Brinks, Loomis, and International Depositories.

- Offshore Storage – Switzerland, Singapore, and Cayman Islands offer asset protection benefits.

💡 Diversify storage locations to reduce risk in case of theft, government confiscation, or disasters.

4. Common Mistakes to Avoid When Investing in Gold & Silver

- Buying at peak prices – Many investors panic-buy when prices are high. Instead, use dollar-cost averaging to spread out purchases.

- Ignoring premiums & fees – Always check the buy-sell spread before purchasing.

- Not having proper storage – Leaving metals in unsafe locations is a huge risk.

- Focusing too much on collectibles – Rare coins often have high markups that don’t justify their value.

5. Gold vs. Silver – Which One Should You Buy?

| Factor | Gold | Silver |

|---|---|---|

| Volatility | Low | High |

| Storage Cost | High | Low |

| Industrial Demand | Low | High |

| Gold/Silver Ratio Indicator | Buy silver if high, buy gold if low | Buy silver if ratio is above 80 |

Now, as you can see, gold is more stable, while silver has higher upside potential. A smart strategy is to hold both and use the gold-silver ratio to time purchases.

6. Start Your Gold & Silver Investing Journey Today

Gold and silver are critical for preserving wealth in 2025.

Whether you choose bullion, ETFs, or mining stocks, investing in precious metals can protect your financial future.

📘 Want to master gold & silver investing? Get your copy of The Stacker’s Handbook – Your complete guide to building wealth with precious metals!

🎥 Watch my YouTube Channel for expert insights on stacking gold & silver!

👕 Stack in style! Check out Stacker’s Gear for premium gold & silver investing apparel and accessories.