Mastering the Gold/Silver Ratio Is A Smarter Way to Stack Gold and Silver

Gold and Silver Ratio Guide: Most investors focus on price—but smart stackers use the Gold/Silver Ratio to build more ounces without spending more. When the ratio swings, so do the opportunities.

📘 Download the full guide: Stackers Handbook — A +100-page expert resource on gold and silver.

In this guide, you’ll learn exactly how the ratio works, why it matters, and how to use it to time your trades, optimize your stack, and outpace passive investors. Whether you’re new to the world of metals or looking to level up your strategy, understanding the Gold/Silver Ratio is one of the smartest moves you can make.

Section One: Understanding the Gold and Silver Ratio

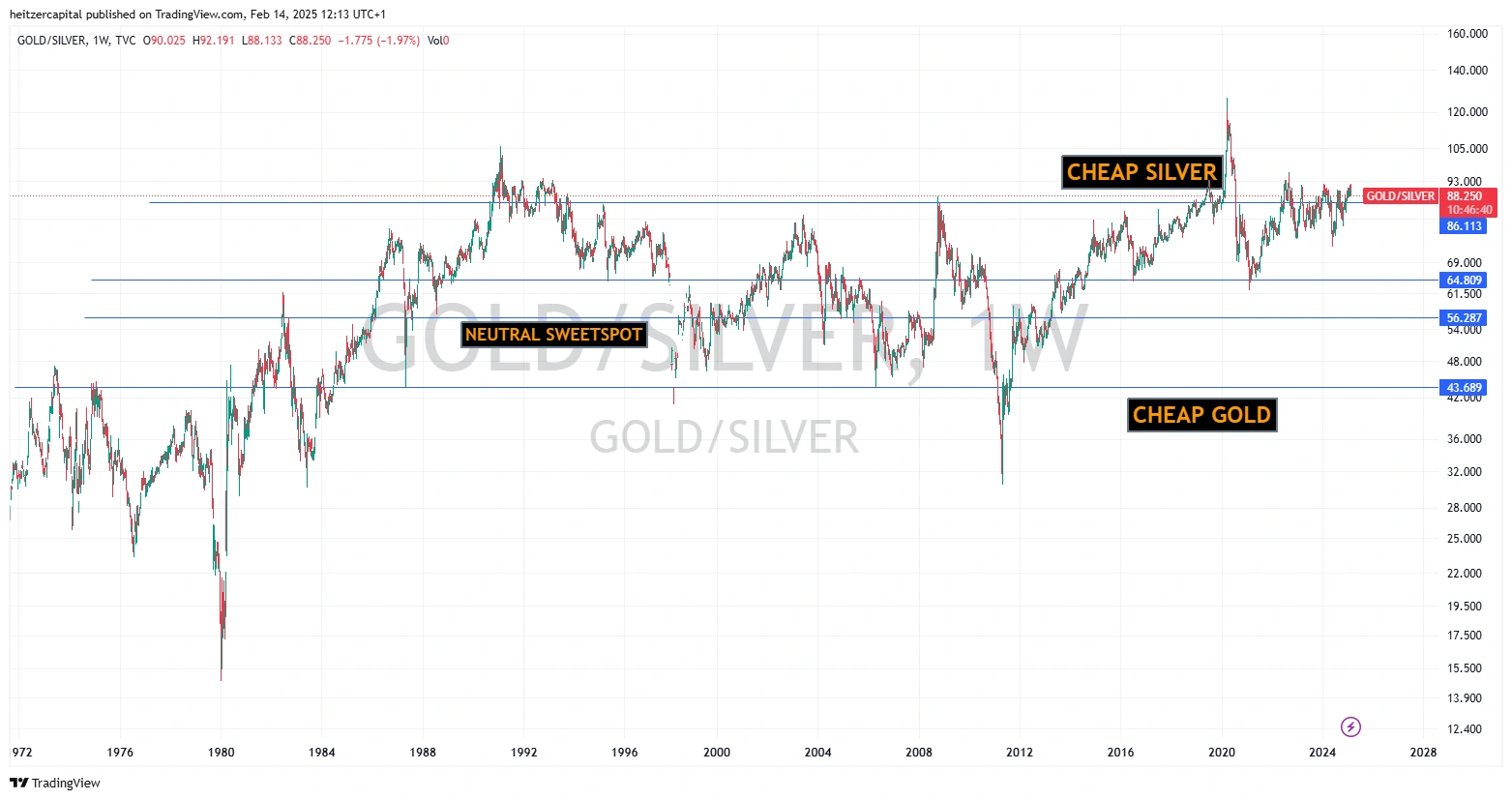

The Gold/Silver Ratio is a concept that measures how many ounces of silver you would need to purchase one ounce of gold. While the idea of “ratio” may sound technical, it is actually straightforward once you see how it influences your buying and selling decisions. When the ratio moves significantly, it can signal when silver is comparatively cheap or when gold offers a better bargain.

Many investors, known as “stackers,” watch the ratio because it can identify hidden opportunities. Silver tends to be more volatile than gold, so if the ratio climbs to an unusually high level, it often implies silver might be undervalued. On the other hand, when the ratio dips, it may mean gold has become a strong buy.

This measurement also allows investors to navigate precious metals markets without overcommitting additional funds. Instead of continually spending money to buy more metal, you can make strategic swaps when the ratio moves in a favorable direction. For example, if you suspect silver is cheap, you might trade your gold for silver, and then later, if the ratio shifts and gold becomes the better deal, you can swap back.

By following the gold and silver ratio guide, you can focus on timing rather than just price alone. Many factors affect gold and silver prices—everything from mining output to geopolitical tensions—but the ratio offers a historical frame of reference. This historical context allows for a more measured approach to accumulating metals, especially when sentiment in the market becomes overly excited or overly pessimistic.

Although the ratio serves as a guide, it is not a foolproof crystal ball. It should be combined with your own research on global economic trends, currency fluctuations, and personal risk tolerance. Nonetheless, understanding the Gold/Silver Ratio is one of the most practical ways to fine-tune any precious metals investment strategy.

Section Two: Exploring Historical Averages

Through centuries of trade, the Gold/Silver Ratio has held symbolic and practical importance. In ancient civilizations, including those of the Roman Empire, silver played a crucial role in coinage alongside gold. Some historical records show that silver and gold were used at a ratio close to ten to one, indicating that silver was far more expensive in proportion to gold than it is today. This insight helps investors understand that the ratio naturally shifts over long periods.

Moving into more modern times, such as the early and mid-twentieth century, the ratio appeared closer to around forty or fifty to one. Economic cycles, monetary policies, and technological changes in mining contributed to this average. The broader availability of silver, along with its industrial usage, influenced how the ratio settled into those ranges over decades.

In more recent years, the ratio has frequently drifted above seventy to one, suggesting silver is relatively cheap compared to gold. During times of economic distress, such as financial crises or global uncertainties, investors often flock to gold as a safe haven. This flight to safety can cause the ratio to expand further because gold prices may rise faster than silver prices.

Yet it’s crucial to remember that “average” is just a starting point. The ratio can occasionally spike or drop in dramatic fashion, presenting quick opportunities for those who react. For instance, a significant global event could cause a sudden rush into gold, while silver lags behind, pushing the ratio to an unusually high level. Eventually, when the market stabilizes, silver may catch up, allowing alert investors to profit from the price swing.

Observing these historical patterns helps investors anticipate possible scenarios. If the ratio approaches levels rarely seen, it can set off an alert that now might be a particularly good time to load up on silver (if it’s exceptionally high) or to pivot to gold (if it has dropped substantially). By blending historical knowledge with current market analysis, you can better gauge when to make your move.

Section Three: Recognizing Historical Trends in the Gold/Silver Ratio

Looking back at significant points in history can be illuminating. In the early nineteen eighties, for example, the ratio dipped dramatically when silver spiked to unprecedented highs. This surge caught many by surprise and showed how quickly silver can move when market sentiment shifts or when speculative fever takes hold.

A different story unfolded around the early nineteen nineties, when silver was languishing at rock-bottom prices. During that period, the ratio soared to a level rarely seen in modern times, implying that the metal was almost forgotten by the broader market. Savvy investors who recognized silver’s underappreciation were able to acquire large amounts at relatively affordable prices.

Fast-forward to moments of extreme market stress, and you might see the ratio balloon again. During events that disrupt global supply chains or cause widespread economic fear, gold often outperforms initially. As a result, the ratio can hit extreme highs, indicating that silver may be overlooked in the rush to safety. Once that panic eases, silver often rebounds, tightening the gap and creating a window for those who were prepared.

Although each historical event has unique causes—ranging from changes in monetary policy to dramatic swings in commodity demand—the ratio’s behavior is surprisingly consistent. It tends to break from its usual trading band during moments of emotional or institutional overreaction. By keeping historical patterns in mind, you can stay rational while others are reacting emotionally, thereby positioning yourself for strategic gains.

In simpler terms, when the ratio reaches extremes, look closer. Extremes do not guarantee an immediate price reversal, but they often open a door for profitable trades. If you spot silver or gold behaving unusually compared to long-term historical norms, that is your cue to dig deeper and consider whether an opportunity is at hand.

Section Four: Strategies for Buying Low and Selling High

Many people in the precious metals space focus purely on price, but the Gold/Silver Ratio offers a more nuanced approach. The typical rule of thumb is that when the ratio rises substantially, silver is cheap relative to gold. Conversely, when the ratio falls considerably, gold might be the better value. Adopting this ratio-centric view can help you decide when to shift your holdings without necessarily adding more capital to your portfolio.

One effective tactic is to set target levels for the ratio. For instance, you might decide that if the ratio reaches an unusually high threshold, you will use some of your gold to purchase silver. Later, if the ratio retreats to a lower level, you can reverse the trade by exchanging the silver for gold. In doing so, you accumulate additional ounces of gold or silver purely by timing the market swings, rather than injecting fresh money.

This strategy requires patience and awareness of real-world events that can push the ratio into uncharted territory. Global financial crises, changes in interest rates, and even shifts in industrial demand can all play a role. Some investors choose to monitor these triggers daily, while others watch monthly or quarterly, depending on their risk appetite and investment horizon.

In addition, it’s wise to keep an eye on premiums associated with physical gold and silver. Premiums are the extra costs above the spot price, and they can impact your effective ratio. If you notice that physical silver carries a higher than usual premium, the advantage you see in the ratio might be offset by these additional costs. By factoring in premiums alongside the ratio, you maintain a more accurate perspective on which metal is truly the better buy.

Lastly, always remember that no single indicator is perfect. Even with the best analysis, markets can behave irrationally for extended periods. If you approach ratio-based trades with discipline, set clear goals, and remain flexible, you can significantly enhance your prospects of buying low and selling high in the precious metals market.

Section Five: Additional Considerations in our Gold and Silver Ratio Guide for Precious Metals Investors

It’s important to recognize that physical gold and silver come with practical considerations such as storage and security. Silver, given its lower price per ounce, requires more space for the same dollar value, and that can influence how much you can realistically hold. Gold, being more compact, can be easier to store, but it also tends to be more expensive per ounce, which might limit the size of your initial position.

Liquidity can also differ between gold and silver, depending on where you live or how you plan to sell. In many global markets, gold coins and bars are extremely liquid, often selling quickly at well-recognized dealerships. Silver can also be sold readily, but large bars might be less convenient to move than smaller coins or bars. If you anticipate frequent trading based on the ratio, consider the forms of bullion that will be easiest for you to exchange.

Taxes and reporting requirements vary by jurisdiction. Some places treat gold and silver similarly, while others differentiate between “collectibles” and bullion. Understanding local regulations can help you keep more of your gains, especially if you plan to make multiple trades as the ratio shifts. Consulting a tax professional or financial advisor can prevent unexpected costs down the line.

Another factor to keep in mind is global monetary policy. Central banks that lower interest rates or engage in quantitative easing can create environments where precious metals flourish. During these times, demand for gold typically surges, which can push the ratio in a direction favorable for silver accumulation. Conversely, if governments raise rates to fight inflation, gold might temporarily lose some luster, and silver might outperform due to industrial demand.

Finally, remember that the Gold/Silver Ratio is just one tool in your investment toolkit. Diversifying across various asset classes, such as stocks, bonds, real estate, and precious metals, can help protect your overall portfolio from market volatility. The ratio is an excellent way to optimize your holdings within the precious metals space, but it should be balanced with a broader wealth-building strategy.

Section Six: Integrating Numismatics with Precious Metals Strategies

Numismatics, the study and collection of coins, provides a whole new dimension to precious metals investing. While the Gold/Silver Ratio focuses on bullion value and market-driven prices, numismatic coins can carry worth far beyond the metal they contain. This happens when a coin’s rarity, historical significance, or condition appeals to collectors, driving up demand and price. By recognizing how these two worlds intersect, you can open up additional pathways for growing and diversifying your holdings.

In the realm of numismatics, certain coins become coveted treasures due to their unique mint errors, low production runs, or storied past. These collectible factors can sometimes overshadow traditional bullion concerns. For instance, rare silver coins may command premium prices that defy the normal metrics used to gauge silver’s spot value. On the flip side, more common bullion coins might carry lower collectible appeal yet align smoothly with the strategies highlighted by the Gold/Silver Ratio.

If you’ve explored our earlier guide on the Top 10 Most Valuable Lincoln Wheat Pennies, you’ll know that some pennies—despite being mostly copper—can be extremely valuable in the collector’s market. This illustrates how numismatics can be a completely different avenue of investment. A small cent can outpace many silver coins in terms of pure resale price if it has the right combination of rarity and condition. As you blend precious metals investing with numismatic pursuits, keep in mind that you’re juggling two separate markets: one driven by metal content and another by collectible prestige.

When merging the Gold/Silver Ratio approach with numismatics, a balanced strategy often works best. You could allocate a portion of your budget to gold or silver bullion, ensuring you can easily leverage ratio swings for timing the market. Meanwhile, you might reserve another portion for rare and historically significant coins that have strong collector demand. This diversification can help buffer you against the typical ups and downs of bullion pricing because numismatic coins are less likely to fluctuate in direct tandem with spot prices.

Though numismatics can add excitement and potential for substantial gains, it also requires careful research. Condition grading, authenticity checks, and knowledge of collector trends are key to making informed purchases. By combining insights from both precious metals valuation and the specialized world of collectable coins, you’ll be in a better position to seize rare opportunities. This dual approach acknowledges the best of both domains—maximizing traditional bullion strategies while tapping into the unique advantages that collectible coins offer.

GoldSilverStacks Insights on Gold and Silver Ratio Guide

The Gold/Silver Ratio is more than a simple figure—it’s a historical compass that can guide your precious metals decisions. By paying attention to extreme swings in the ratio, you can spot when silver is underpriced or when gold offers a stronger value. Investors who learn to harness these signals often manage to grow their holdings without adding more capital, simply by timing their trades and patiently observing market conditions.

Keep in mind that every investor’s journey is unique. Your personal goals, risk tolerance, and outlook on the global economy will shape how you use this ratio. Stay informed, remain flexible, and always do your own research. With a measured approach, the Gold/Silver Ratio can help you buy low, sell high, and come out ahead in the ever-evolving world of precious metals. Good luck, and may your investments shine brightly!

✨ Pro Tip: Always combine the ratio with your broader market research. It can help confirm trends, but it should never be the only factor driving your decisions.