Gold Silver Ratio – The Stacker’s Handbook

50% Off in February!

Get out of the dollar before it’s too late.

Worried about the economy, the dollar’s collapse, and a looming recession? Mastering The Gold Silver Ratio – The Stacker’s Handbook is your ultimate guide to protecting your savings with gold and silver investments.

Is This Book Right For You?

No matter where you are on your stacking journey, The Stacker’s Handbook has something for everyone.

New Stackers

If you’re new to gold and silver, this book will guide you through every step—from your first purchase to building a strong, sustainable portfolio.

Experienced Investors

Already stacking? The Stacker’s Handbook elevates your expertise with advanced strategies to maximize returns, master the Gold-Silver ratio, and strengthen your portfolio for the long term.

Savvy Stackers

Learn how to capitalize on market opportunities, avoid common pitfalls, and make confident decisions that secure your financial future.

Trusted Source of Information for Gold and Silver Stackers

About Mastering The Gold-Silver ratio For Wealth & Stability

The Stacker’s Handbook isn’t just another guide—it’s the definitive roadmap to mastering gold, silver, and the Gold-Silver ratio. Whether you’re stacking for the first time or refining an already substantial portfolio, this book delivers the tools you need to confidently navigate any market condition.

In this easy to read 100 page book, you’ll uncover:

- A Lifetime Strategy for Success: Know exactly what to do at all times, with a proven plan that eliminates uncertainty and helps you stack effectively in every market environment.

- Clear, Actionable Insights: This isn’t theory; it’s actionable intelligence that wealthy investors use to secure their future. Don’t deny yourself the opportunity to benefit from insights that will grow your stacks exponentially over time.

- Simple and Easy to Implement: From understanding seasonality to leveraging strategic tactics with the Gold-Silver ratio, this guide ensures you stay ahead of the crowd—because knowing what to do at the right time is what separates exceptional performance from mediocrity.

- The Tools to Build and Protect Wealth: With step-by-step guidance, learn to avoid common pitfalls, time your moves with precision, and turn silver’s sharp rallies into gold’s ounces.

This book gives you the confidence to act decisively, knowing you’ll be prepared for any economic climate. You’ll know exactly how to allocate cash effectively, rebalance your portfolio, trade the ratio opportunistically and have clear measures and tools to implement it immediately. Judge it by the results—once you see the returns, you’ll never stack without the principles described on the book again.

The Stacker’s Handbook isn’t something you should think about—it’s something you need to own. Because when it comes to securing your financial future, “the worst decision is no decision.”

Get the Stacker’s Handbook NowDiscover the Ultimate Guide to Precious Metals Investing

Why Gold and Silver

Understand the history behind gold and silver and why these metals are essential in modern portfolios.

The Power of the Gold-Silver Ratio

Learn about valuing your wealth in metals,how to flip your stack strategically at the right time, and how to increase the amount of ounces you hold long term without fiat risk.

Proven Strategies

From managing premiums to building a resilient portfolio, learn tactics to maximize returns and minimize risks without relying on third parties.

Practical Insights

Actionable tactics designed to optimize your investments and build your wealth systematically.

A Lifetime of Value

This book provides a comprehensive roadmap, equipping you with the tools to confidently navigate precious metals markets for life—no other resources needed- in a simple and easy to implement manner.

Avoiding Common Pitfalls

Learn to sidestep costly mistakes that often trap new and experienced stackers alike, ensuring you stay on the path to success.

The Dollar’s Collapse and Why the Gold to Silver Ratio Matters

The purchasing power of the U.S. dollar has been on a steady decline for over a century. Inflation, excessive government spending, and aggressive monetary expansion have eroded its value, making it less reliable as a store of wealth. This is why many investors turn to stacking gold and silver as a hedge against inflation and financial uncertainty.

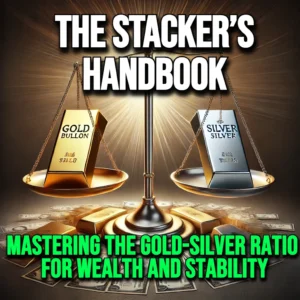

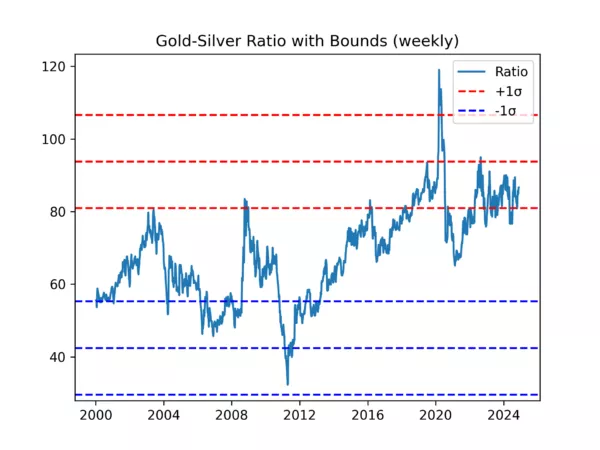

A crucial metric for making strategic investment decisions is the gold silver ratio—the number of ounces of silver needed to buy one ounce of gold. Historically, this ratio has signaled when silver is undervalued or overvalued relative to gold, offering opportunities to stack and trade effectively. By analyzing gold silver ratio charts, investors can navigate market fluctuations and maximize their metal holdings over time.

The Declining Purchasing Power of the Dollar in Gold and Silver Terms

Fiat currencies are inherently unstable over long periods, while gold and silver have maintained purchasing power for thousands of years.

- In 1913, one dollar could buy 100 loaves of bread. Today, it buys only a few.

- In 1971, gold was $35 per ounce, and silver was $1.50 per ounce, setting a gold-silver ratio of 24:1.

- In 2020, amid peak economic uncertainty, the ratio soared above 120:1, marking one of the most extreme dislocations in history.

Measuring wealth in gold and silver instead of fiat currency provides a stable perspective on purchasing power.

Ready to Stack Like a Pro? Use the Gold to Silver Ratio to Multiply Your Ounces

The gold and silver ratio is not just history. It is a powerful tool that allows you to grow your stack without spending more money. Knowing when to buy silver, when to flip into gold, and how to time your moves is what separates stackers who barely keep up from those who build serious wealth.

Inflation, Monetary Expansion, and the Gold-Silver Ratio

One of the biggest factors behind the dollar’s decline is inflation. The Federal Reserve and central banks have aggressively expanded the money supply, accelerating currency devaluation.

- The M2 money supply in 1971 was $600 billion. In 2024, it exceeds $21 trillion.

- The U.S. national debt has surpassed $34 trillion, ensuring continued currency devaluation.

- Since 2020, over 40% of all dollars in circulation have been printed, fueling inflation.

During these periods of monetary expansion, the gold silver ratio fluctuates wildly, creating opportunities for stackers. Historically:

When the ratio drops below 40:1, gold is better positioned for long-term stability.

When the ratio is above 80:1, silver is undervalued—a strong buying opportunity.

How to Use the Gold-Silver Multiple for Profit

1) Buy Silver When The Ratio Is High

When gold gets too expensive compared to silver, buying silver allows you to accumulate more ounces for less. Stackers who follow this strategy increase their total weight without extra cash investment.

2) Swap Into Gold When The Ratio Drops

When silver prices surge, history shows that gold holds its value better in the long run. The smart move? Trade silver for gold when the ratio contracts.

3) Cycle Between Gold and Silver To Multiply Your Holdings

By flipping between metals based on ratio movements, stackers can double or triple their ounces over time. This is how real wealth is built, and it is all explained in The Stacker’s Handbook.

Using the Gold and Silver Ratio Chart to Measure Real Wealth

Instead of measuring wealth in fiat currency, investors can assess assets in gold and silver terms for a more accurate perspective.

- In 1980, gold hit $850 per ounce, silver surged to $50 per ounce, and the ratio dropped to 17:1—a rare moment when silver outperformed gold.

- In 1991, the ratio spiked near 100:1, marking a prime buying opportunity for silver.

- In 2020, during the global crisis, the ratio hit an all-time high of 120:1, making silver historically cheap relative to gold.

By tracking gold silver ratio charts, investors can buy low and sell high, optimizing their metal holdings over time.

Why the History of Gold-Silver Multiple Matters For Stackers

The gold-silver ratio has been a cornerstone of monetary history and a key metric for investors looking to capitalize on the relative value of these two metals. By analyzing gold-silver ratio charts over centuries, we can see how shifts in monetary policy, supply and demand, and financial crises have impacted its movement.

Understanding this ratio doesn’t just provide historical context, it delivers actionable insights on when to buy gold or silver based on cyclical price movements.

The Ancient Gold and Silver Ratio – A 10:1 Foundation

Historically, civilizations placed a significant premium on gold due to its rarity, durability, and resistance to corrosion. However, silver’s relative abundance made it more practical for everyday transactions.

- Ancient Egypt (circa 3,000 BCE): Records suggest that the ratio of gold to silver was around 2.5:1, with gold being the metal of the elite and silver used as an intermediary form of money.

- Babylonian Empire (circa 700 BCE): The gold-silver ratio was closer to 6:1, a rate that persisted through various Mesopotamian dynasties.

- Classical Greece (circa 500 BCE): Greek states, particularly Athens, operated on a ratio of 12:1, influenced by silver mines such as the Laurion mines, which provided a steady supply of silver coinage.

- Roman Empire (27 BCE – 476 CE): The Roman monetary system favored a 12:1 to 15:1 gold-silver ratio, reflecting both mining production and the empire’s economic structure.

The Ancient Gold-Silver Ratio shaped early economies, influencing trade, wealth distribution, and laying the foundation for global monetary systems. From Egypt to Rome, discover how civilizations valued gold and silver over time. Read the full history →

The Gold and Silver Ratio in Medieval and Renaissance Europe

As societies moved away from barter systems and embraced standardized coinage, the gold-silver ratio played an essential role in trade and monetary stability.

- Middle Ages (800–1400): The ratio fluctuated between 10:1 and 16:1, often depending on whether new silver sources were discovered.

- The Spanish Silver Boom (1500s–1600s): The influx of silver from the New World, particularly from the mines of Potosí (modern-day Bolivia), caused a decline in silver’s relative value, pushing the ratio closer to 15:1.

- Late 18th Century: The bimetallic standard of many European nations kept the ratio around 15:1 to 16:1 as governments attempted to stabilize their economies.

The Medieval Gold-Silver Ratio played a crucial role in shaping European economies, fluctuating with trade, mining discoveries, and economic policies. From the Middle Ages to the rise of global silver markets, explore how the ratio evolved over time. Read the full history →

The Gold and Silver Ratio in the United States: From 15:1 to 80:1

- 1792: The Coinage Act of 1792, which established the U.S. Mint, legally set the ratio at 15:1, following European standards.

- 1834: The U.S. adjusted the ratio to 16:1, effectively overvaluing gold relative to silver. This decision led to silver disappearing from circulation as people hoarded it.

- 1873: The Crime of 1873 demonetized silver, ending the U.S. bimetallic standard and causing silver prices to decline. By the late 1800s, the ratio had widened to 30:1.

- 1934: The Gold Reserve Act devalued the U.S. dollar and increased the gold price, but silver’s price remained relatively stable, pushing the ratio to 35:1.

The Gold-Silver Ratio in the United States evolved through major legislative shifts, shaping the country’s monetary history. Read the full history →

The Gold and Silver Ratio in Modern History

The shift from a monetary system backed by precious metals to fiat currency in the 20th century led to increased volatility in the gold-silver ratio. Unlike earlier periods when governments set fixed ratios, modern financial markets allowed gold and silver to trade freely, leading to extreme fluctuations in their relative value.

Since the end of the gold standard, the gold-silver ratio has been shaped by inflation cycles, financial crises, and changing industrial demand for silver. Key moments in modern history illustrate how this ratio responds to economic uncertainty and speculative pressures.

Explore the full history of the Gold and Silver Ratio in Modern History →, covering the Nixon Shock, the Hunt Brothers’ silver squeeze, and the financial crises that shaped the markets.

Major Events That Shaped the Modern Gold-Silver Ratio

- 1971 – The Nixon Shock and the End of Bretton Woods: The collapse of the gold standard caused gold prices to rise dramatically, pushing the ratio from 40:1 to over 50:1 as silver struggled to keep pace.

- 1980 – The Hunt Brothers’ Silver Squeeze: An attempt to corner the silver market sent prices soaring, briefly narrowing the ratio to 17:1 before a dramatic collapse.

- 1991 – The Recession and Silver’s Weakness: The ratio hit a then-record high of 100:1 as a global recession crushed silver demand while gold remained a safe haven.

- 2008 – The Financial Crisis and Silver’s Boom: The ratio spiked to 80:1 during market panic before crashing back to 30:1 in 2011, when silver surged to nearly $50 an ounce.

- 2020 – The COVID-19 Crash and Recovery: The ratio reached an all-time high of 126:1 as silver collapsed faster than gold due to industrial demand declines. However, it quickly reversed as silver rebounded.

Each of these events highlights the evolving relationship between gold and silver in a world where monetary policy, economic instability, and market speculation drive price movements. Understanding these shifts provides valuable insight into how the gold-silver ratio serves as a market indicator for investors and precious metals stackers.

Why You Need This Now

The gold and silver ratio chart tells a compelling story about how financial markets have evolved over time. While the days of bimetallic monetary systems are long gone, this ratio remains one of the most reliable indicators for stacking and trading metals strategically.

If you’re serious about gold and silver investing, you can’t afford to ignore the gold silver ratio. The biggest mistake stackers make is buying at randomy without understanding when silver is cheap or gold is overvalued. This book eliminates the guesswork, giving you a systematic approach to stacking.

You don’t need to speculate—just follow the strategies in The Stacker’s Handbook and build wealth like the pros without taking FIAT currency risk.